Your Essential Guide to Avoiding Sky-High Costs

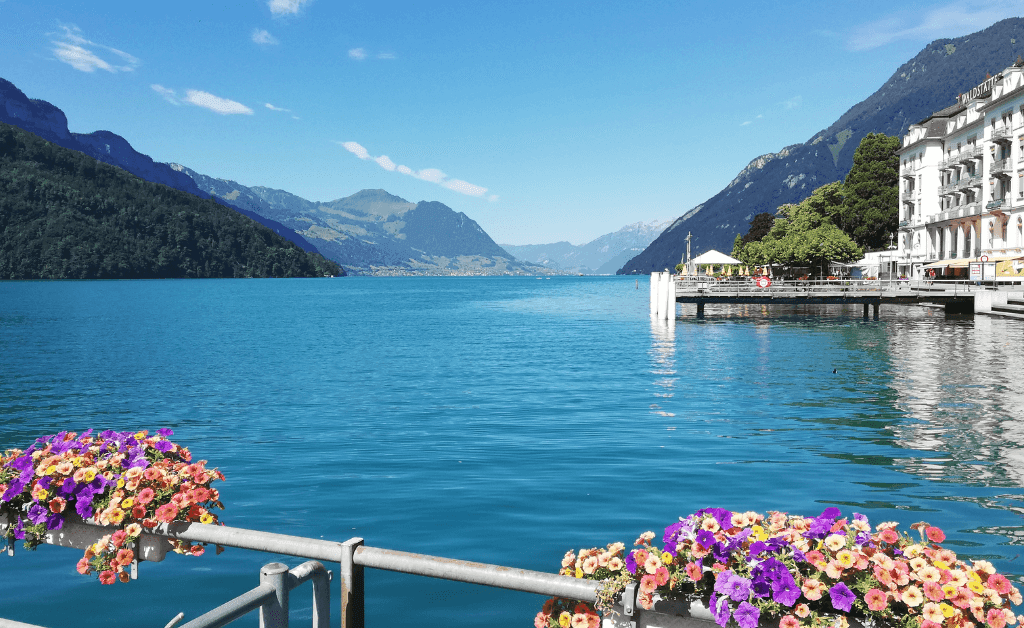

Dreaming of turquoise lakes, soaring Alpine peaks, and charming villages? Switzerland is a bucket-list destination for many, offering breathtaking beauty and unforgettable experiences.

But amidst the planning for scenic train rides and delicious fondue, there’s one crucial element often overlooked: travel insurance. While Switzerland is incredibly safe, accidents and illnesses can happen anywhere.

And in Switzerland, unexpected medical care or mountain rescue can come with a truly staggering price tag. This guide will explain exactly why Switzerland travel insurance isn’t just recommended – it’s essential for protecting your health and your wallet.

We’ll dive into the potential costs, what coverage you need, how to choose the right policy, and recommend trusted providers to ensure your Swiss adventure is memorable for all the right reasons.

Key Takeaways: Switzerland Travel Insurance Essentials

- Crucial, Not Optional: Travel insurance is vital for Switzerland due to extremely high healthcare and rescue costs.

- High Medical Expenses: Even minor treatments can cost thousands; serious incidents can lead to astronomical bills.

- Mountain Rescue Costs: Helicopter rescues in the Alps can easily exceed CHF 10,000 (or USD 11,000+).

- Schengen Requirements: Many non-EU/EFTA visitors must have compliant travel medical insurance (€30,000 minimum coverage) to enter.

- Comprehensive Coverage Needed: Look beyond basic medical; include trip cancellation, baggage loss, and adventure sports if applicable.

- Compare Carefully: Policies vary significantly. Read the fine print, check coverage limits, deductibles, and exclusions.

Disclosure: This post contains affiliate links. If you buy through them, I’ll earn a small commission at no extra cost to you. Thanks for supporting my work!

Why Do You Absolutely Need Travel Insurance for Switzerland?

Let’s be blunt: Switzerland is one of the most expensive countries in the world. While the quality of life and services are exceptional, this high standard comes at a cost, especially regarding healthcare.

Ignoring travel insurance for your Swiss trip is a significant financial gamble you don’t want to take.

The Shocking Reality of Swiss Medical Costs

Imagine twisting an ankle while hiking or catching a severe flu. In many countries, the resulting medical bill might be manageable. In Switzerland? Think again.

A simple doctor’s visit can easily cost several hundred Swiss Francs (CHF). Emergency room visits start higher and climb rapidly depending on tests and treatments.

A hospital stay? Prepare for bills reaching thousands, even tens of thousands, of Francs per day. Complex surgeries or extended ICU care can quickly run into hundreds of thousands.

Without adequate insurance, a medical emergency in Switzerland could lead to life-altering debt.

Mountain Rescue: An Expensive Necessity in the Alps

Switzerland’s stunning mountains are a major draw for hikers, skiers, and climbers. But the Alps can be unpredictable. Weather changes rapidly, and accidents happen.

If you get injured or lost in the mountains and require rescue, especially by helicopter, the costs are astronomical. Swiss air rescue services like Rega are world-class, but they aren’t free for tourists.

A helicopter rescue mission can easily cost between CHF 3,000 and CHF 10,000+, depending on the location, complexity, and duration. Your standard health insurance from home likely won’t cover this.

Proper travel insurance, especially policies covering adventure sports and search and rescue, is critical if you plan to explore the Swiss mountains.

Schengen Visa Insurance Requirements

If you are a citizen of a country requiring a Schengen visa to enter Switzerland (and the wider Schengen Area), having compliant travel medical insurance is mandatory.

The requirements typically include:

- Minimum coverage of €30,000 (approx. CHF 29,000 or USD 32,000).

- Coverage for emergency medical expenses, hospitalization, and repatriation (including in case of death).

- Validity throughout the entire Schengen Area.

- Validity for the entire duration of your stay.

You’ll usually need to provide proof of this insurance when applying for your visa. Failure to have it can result in visa denial.

Even if you don’t need a visa, meeting these minimums is a good baseline for adequate coverage given Swiss medical costs. You can find more details on entry requirements in our Switzerland Visa and Entry Requirements guide.

Beyond Medical: Covering Your Entire Trip Investment

Good travel insurance isn’t just about health emergencies. It also protects the financial investment you’ve made in your trip.

Consider these common travel mishaps:

- Trip Cancellation: What if you get sick before leaving, or a family emergency prevents you from travelling? Insurance can reimburse non-refundable costs like flights and hotels.

- Trip Interruption: If you need to cut your trip short due to a covered reason, insurance can help cover the costs of returning home early and unused portions of your trip.

- Lost or Delayed Baggage: Airlines can lose luggage. Insurance can provide funds to buy essentials while you wait or reimburse you if your bags are permanently lost.

- Travel Delays: Significant delays can mean extra accommodation or meal costs. Some policies offer coverage for this.

- Personal Liability: If you accidentally injure someone or damage property, liability coverage can be a lifesaver.

What Should Your Switzerland Travel Insurance Cover?

Not all travel insurance policies are created equal. When choosing a plan for Switzerland, ensure it includes robust coverage in key areas:

Essential Medical Coverage

- High Emergency Medical Limit: Given Swiss costs, aim for much higher than the €30,000 Schengen minimum. Look for policies offering at least $100,000 USD, preferably $250,000 USD or more, in emergency medical coverage.

- Emergency Evacuation & Repatriation: This covers the cost of transporting you to a suitable medical facility or back to your home country if medically necessary. This can easily cost tens or even hundreds of thousands of dollars. Ensure coverage is high (e.g., $500,000+).

- Hospitalization & Outpatient Care: Covers costs for stays, treatments, doctor visits, and prescribed medications.

- Dental Emergencies: Covers acute pain relief or emergency dental treatment. Often has lower limits.

Adventure Sports & Activities Coverage

Planning to ski, snowboard, hike at high altitudes, paraglide, or engage in other adventurous activities? Standard policies often exclude these.

You must check if your policy covers the specific activities you plan to do. Often, you’ll need to purchase an add-on or choose a policy specifically designed for adventure travel.

Crucially, ensure this includes search and rescue coverage, especially for mountain activities.

Trip Cancellation & Interruption

This protects your prepaid, non-refundable trip costs. Ensure the coverage limit is high enough to cover your major expenses (flights, accommodation, tours).

Read the covered reasons for cancellation/interruption carefully (e.g., illness, injury, death of a family member, job loss, natural disasters).

Baggage & Personal Belongings

Provides reimbursement if your luggage is lost, stolen, or damaged. Note that there are often per-item limits and specific exclusions (e.g., cash, electronics might have lower limits).

Coverage for baggage delays allows you to purchase necessary items if your bags are held up.

Personal Liability

Covers legal expenses or damages if you’re found responsible for injuring someone or damaging their property during your trip.

Rental Car Excess (Optional Add-on)

If you plan to rent a car in Switzerland, the rental company’s basic insurance often comes with a high excess (deductible). Travel insurance policies sometimes offer an add-on to cover this excess, which can be cheaper than buying the rental company’s waiver.

Types of Travel Insurance Policies

Understanding the different types of policies helps you choose the right fit:

Single Trip vs. Multi-Trip Annual

- Single Trip: Covers one specific trip with defined dates. Ideal if you only travel once or twice a year.

- Multi-Trip Annual: Covers all trips you take within a year (up to a maximum duration per trip, e.g., 30 or 60 days). Cost-effective if you travel frequently.

Basic vs. Comprehensive

- Basic/Medical Only: Primarily covers emergency medical expenses and repatriation. May meet Schengen requirements but lacks trip cancellation, baggage etc.

- Comprehensive: Offers a wider range of benefits, including medical, cancellation, interruption, baggage, liability, and often higher coverage limits. Generally recommended for Switzerland.

Backpacker/Long-Stay Insurance

Designed for longer trips (months), often with more flexibility and potentially different coverage structures. Some providers like SafetyWing specialize in this.

How to Choose the Best Travel Insurance for Switzerland

With so many options, how do you pick the right one? Follow these steps:

1. Assess Your Trip Details

Consider:

- Duration: Single trip or multiple trips?

- Activities: Will you engage in adventure sports?

- Destination(s): Just Switzerland or other countries too? (Ensure coverage area).

- Value of Trip: How much non-refundable cost needs cancellation coverage?

- Travelers: Solo, couple, family? (Family plans can be economical).

2. Compare Policy Wording Carefully

This is crucial. Don’t just look at the headline benefits. Read the Policy Document or Description of Coverage.

Pay close attention to:

- Exclusions: What is *not* covered? Common exclusions include pre-existing conditions (unless specifically covered), high-risk activities (unless added), incidents involving alcohol/drugs, pandemics (check specific wording).

- Definitions: How does the policy define “emergency,” “pre-existing condition,” etc.?

3. Check Coverage Limits & Deductibles

Ensure limits are adequate, especially for medical and evacuation. Understand the deductible (or excess) – the amount you pay out-of-pocket before insurance kicks in. Lower deductibles usually mean higher premiums.

4. Look at Customer Reviews & Insurer Reputation

Check independent review sites (like Trustpilot) and forums. How does the company handle claims? Are they responsive and fair?

Consider the underwriter’s financial stability rating (e.g., AM Best).

5. Declare Pre-existing Conditions

Be honest about any pre-existing medical conditions. Failure to declare can void your coverage. Some policies offer waivers or cover stable pre-existing conditions, but read the terms carefully.

Recommended Travel Insurance Providers for Switzerland

Several reputable companies offer travel insurance suitable for Switzerland. Here are a few popular options (remember to compare specific plans based on your needs):

Visitors Coverage

Visitors Coverage is a leading marketplace offering a wide range of plans from different top-rated insurance providers. This makes it easy to compare options side-by-side based on your specific requirements (Schengen visa needs, adventure sports, budget etc.). They have plans suitable for various traveler types and trip lengths.

SafetyWing (Nomad Insurance)

SafetyWing’s Nomad Insurance is particularly popular with digital nomads, long-term travelers, and those needing flexibility. It operates on a subscription basis that you can start even after you’ve left home. It offers solid medical coverage and includes limited home country coverage. Check their policy details for specific activity coverage.

EKTA

EKTA offers various travel insurance packages, often catering well to European travel and Schengen requirements. They provide different tiers of coverage, allowing you to choose based on your budget and needs. Review their specific policy details for Switzerland trips.

Pro Tip: Get quotes from at least 2-3 providers using the links above to compare coverage and pricing accurately for your specific trip details.

Planning the Rest of Your Swiss Adventure

Once your essential travel insurance is sorted, you can focus on the fun parts of planning your Swiss journey!

Finding Flights to Switzerland

Major international airports include Zurich (ZRH), Geneva (GVA), and Basel (BSL). Use flight comparison tools to find the best deals.

Consider flying with CheapOair for competitive fares.

Booking Accommodation

Switzerland offers everything from luxury hotels to cozy guesthouses and budget-friendly hostels. Book in advance, especially during peak season.

Compare prices and options using these platforms:

- Hotels: Expedia, Booking.com, Agoda, Trip.com

- Hostels: Hostelsworld

- Price Comparison: Trivago

Looking for hotels in specific cities? Check out deals here:

- Zurich: Expedia Zurich Deals | Agoda Zurich Deals

- Lucerne: Expedia Lucerne Deals | Agoda Lucerne Deals

- Interlaken: Expedia Interlaken Deals

- Grindelwald: Expedia Grindelwald Deals

- Zermatt: Expedia Zermatt Deals

Getting Around Switzerland

Switzerland boasts an incredibly efficient public transport system. Consider the Swiss Travel Pass for unlimited travel on trains, buses, boats, and premium panoramic trains, plus free entry to hundreds of museums. Learn more in our Complete Guide to the Swiss Travel Pass.

Alternatively, the Swiss Half Fare Card gives 50% off most public transport.

If you prefer driving, renting a car with Discover Cars offers flexibility, especially for exploring more remote areas.

Booking Tours & Activities

From stunning mountain excursions to city tours, booking activities in advance is recommended.

Check out popular options on GetYourGuide and Viator. Some must-do experiences include:

- Jungfraujoch – Top of Europe

- Mount Pilatus Golden Round Trip

- Mount Titlis Day Tour

- Bernina Express Scenic Train

- Paragliding in Interlaken

Staying Connected

Avoid hefty roaming charges with an eSIM. Yesim offers convenient data plans for Switzerland and Europe.

Essential Travel Gear

Pack smart for Switzerland’s variable weather. Don’t forget essentials like a universal travel adapter, a portable power bank, and a reusable water bottle (Swiss tap water is excellent!).

Check out our guide to 10 Useful Amazon Products Every Traveler to Switzerland Needs for more ideas.

As an Amazon Associate, I earn from qualifying purchases.

Conclusion: Don’t Risk Your Swiss Dream

Switzerland is an incredible country offering unparalleled natural beauty and cultural experiences. However, the potential for sky-high medical and rescue costs makes comprehensive travel insurance an absolute necessity.

It protects you from potentially devastating financial consequences due to unexpected illness or injury, covers trip cancellations and interruptions, and provides peace of mind, especially if you plan on enjoying adventure activities in the Alps.

Take the time to research and compare travel insurance policies from providers like Visitors Coverage, SafetyWing, or EKTA. Choose a plan with adequate coverage for medical emergencies, evacuation, and any specific activities you’ll undertake.

Investing in good travel insurance is investing in a worry-free, unforgettable Swiss adventure. Safe travels!

Frequently Asked Questions (FAQ) about Switzerland Travel Insurance

1. Do I really need travel insurance for Switzerland?

Yes, absolutely. While Switzerland is safe, medical and rescue costs are extremely high. A minor accident or illness can result in bills costing thousands or tens of thousands of dollars. Insurance protects you from this significant financial risk. It’s also mandatory for travelers needing a Schengen visa.

2. How much does travel insurance for Switzerland cost?

Costs vary widely based on your age, trip duration, coverage level (medical limits, cancellation amount), deductible chosen, and any add-ons (like adventure sports). Expect to pay anywhere from 4% to 10% of your total non-refundable trip cost for a comprehensive policy. Get quotes for accurate pricing.

3. I have a European Health Insurance Card (EHIC/GHIC). Do I still need travel insurance?

EHIC/GHIC provides access to *state-provided* healthcare in Switzerland at the same cost as a local resident (which may still involve co-pays). It does NOT cover private healthcare, mountain rescue, repatriation, trip cancellation, lost baggage, or liability. Therefore, comprehensive travel insurance is still highly recommended even for EHIC/GHIC holders.

4. Does travel insurance cover activities like skiing or hiking in the Alps?

Often, standard policies exclude “risky” activities. You MUST check the policy details. Many insurers offer specific winter sports or adventure sports add-ons, or you may need a specialized policy. Ensure it explicitly covers the activities you plan and includes search and rescue.

5. What’s the minimum medical coverage needed for Switzerland?

For Schengen visa applicants, the minimum is €30,000. However, due to Switzerland’s high costs, this is generally considered insufficient. Aim for policies with at least $100,000 USD, ideally $250,000 USD or more, in emergency medical coverage, plus substantial emergency evacuation/repatriation coverage (e.g., $500,000+).

6. Can I buy travel insurance after I’ve already started my trip?

Most traditional travel insurance policies must be purchased before your trip begins. However, some providers, like SafetyWing, specialize in insurance that can be bought or extended while already traveling.